More AIG idiocies

2009-03-18 16:15:12.414663+01 by

Dan Lyke

19 comments

AIG Chairman spouts idiocies:

"No one knows better than I that AIG has been the recipient of generous amounts of governmental financial aid. We have been the beneficiary of the American people's forbearance and patience," Liddy said. But he also said that "we have to continue managing our business as a business — taking account of the cold realities of competition for customers, for revenues and for employees."

"Continue", Edward Liddy? That's the freakin' point: You could go down to the local Starbucks and get people who'd be making better corporate financial decisions. You need to start managing your business as a business, rather than as a bigger version of a street corner 3 card monte game.

Although, as John S.J. Anderson points out:

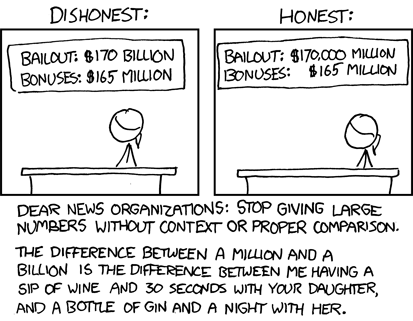

is wondering why/who wants me distracted by outrage over !AIG bonuses (it's <0.1% of the total $$$ FFS...) what else is going on? !cynicism

[ related topics:

Games Work, productivity and environment

]

comments in ascending chronological order (reverse):

#Comment Re: made: 2009-03-18 18:33:35.995977+01 by:

TheSHAD0W

"We are required by contract to pay these people; if we do not, they will sue us, and win. If you want to change the law and prevent it, go ahead; otherwise, quit bugging us."

#Comment Re: made: 2009-03-18 19:22:37.889468+01 by:

Dan Lyke

Lawsuits occur all the time. As a now involuntary stockholder in AIG, any board answerable to me should say "Bring it", and counter-sue on the grounds that the current state of AIG is what these morons were hired to prevent.

Especially since these would be civil matters, not criminal ones.

I wonder what the real game here is, I suspect it has to do something with that shady London office.

#Comment Re: made: 2009-03-18 22:36:50.866969+01 by:

Dan Lyke

Oh, yeah: Renegotiation with the potential recipients of these bonuses is also easy: Just threaten bankruptcy, at which point those alleged contractual issues end up in front of a judge sorting out the desires of those who drove the company into the ground against the shareholders and insured customers.

#Comment Re: made: 2009-03-19 16:49:41.847165+01 by:

Dan Lyke

A little backpedaling: It was suggested to me this morning that "retention bonus" may have been misinterpreted. The purpose of some of these payments was to get people to stay around for the half a year or so that it took to shut down a product or division, rather than immediately jumping ship when they knew their group was going down.

That could temper my view on it a little, although I still think that viewing these as just more claims against the company in the way that a bankruptcy court would is the right way to move forward.

#Comment Re: made: 2009-03-20 04:59:49.104715+01 by:

TheSHAD0W

[edit history]

#Comment Re: made: 2009-03-20 10:59:02.643659+01 by:

John Anderson

Shadow, I was just dropping by here to link that very same xkcd... 8^)

#Comment Re: made: 2009-03-21 04:32:31.372306+01 by:

TheSHAD0W

http://online.wsj.com/article/SB123757098072897381.html

Looks like the law the House passed will wind up taxing some AIG employees at a 102% rate for their total income.

#Comment Re: made: 2009-03-21 12:56:25.484395+01 by:

meuon

The governments ability to use the IRS as a punitive agency is just plain scary.

#Comment Re: made: 2009-03-21 13:28:17.815311+01 by:

Dan Lyke

I wonder how this is going to play out through the senate, which usually manages to quietly sink the grand gestures of the house, and, if it gets beyond that, through signing or veto. I'm guessing that in his attempts to punish a few and deflect some attention Liddy may have unleashed more than he intended...

#Comment Re: made: 2009-03-22 16:08:54.496865+01 by:

ziffle

Article one if the US Constitution:

The privilege of the writ of habeas corpus shall not be suspended, unless when in cases of rebellion or invasion the public safety may require it.

No bill of attainder or ex post facto Law shall be passed.

No capitation, or other direct, tax shall be laid, unless in proportion to the census or enumeration herein before directed to be taken.

No tax or duty shall be laid on articles exported from any state.

I hope the Supremes can read.

#Comment Re: made: 2009-03-22 17:28:13.475769+01 by:

Dan Lyke

If that were the case they'd throw out the ex post facto laws that created the bailout and criminally charge these guys before dropping them in debtor's prison.

#Comment Re: made: 2009-03-24 15:04:31.745512+01 by:

ziffle

Small steps to fascism:

Obama wants power to seize more firms:

"We're very late in doing this, but we've got to move quickly to try and do this because, again, it's a necessary thing for any government to have a broader range of tools for dealing with these kinds of things, so you can protect the economy from the kind of risks posed by institutions that get to the point where they're systemic"

So they will protect the ecomony by nationalizing it.

#Comment Re: made: 2009-03-24 16:55:31.845793+01 by:

Dan Lyke

I guess I'm having trouble raising my outrage: This is essentially extending regulation and terms out to operations that had previously used loopholes to avoid basic accountability. I think we've seen what happens when scam artists financial services firms operate without oversight or audit, and this is a rational response to that.

#Comment Re: made: 2009-03-25 00:24:11.811861+01 by:

jeff

[edit history]

Here is a great article which goes into some detail what happened at AIG.

#Comment Re: made: 2009-03-25 12:54:46.427965+01 by:

Dan Lyke

And Five Thirty Eight looks at why AIG paid the "bonus"es.

#Comment Re: made: 2009-03-25 15:19:14.83547+01 by:

ziffle

Soon America? Prime Minister?

#Comment Re: made: 2009-03-25 20:03:35.75955+01 by:

dexev

Dan, the trouble I see with the powers Obama wants is that they'd go to the political nominees in the Treasury Department, instead of (at least nominally) independent agencies like the FDIC or SEC that we have now.

(I'd also argue that the situation we're in now is due more to the government's active encouragement of poor business practices, than any lack of regulation.)

#Comment Re: made: 2009-03-25 20:57:10.228561+01 by:

Dan Lyke

dexev, I'll grant your concerns over who gets the powers, but I've seen the arguments around the "Community Reinvestment Act" and found them wanting. What are the arguments you've seen laying this on excessive regulation? Seems to me like CDOs, and the fact that AIG didn't have enough reserves to cover the insurance policies they were writing, come from a lack of oversight.

#Comment Re: made: 2009-03-25 21:49:47.940416+01 by:

jeff

[edit history]

In this particular instance, I couldn't agree more, Dan...

The amount of leverage the banks were using (and AIG insuring) by layering these various "financial instruments" on top of each other was more than just a single order of magnitude. And with "the continuing bailout" largely coming at the expense of the U.S. taxpayer, these "institutions" were/are gambling with your children's future.

And they lost. An entire generation, if not many more.

We will not edit your comments. However, we may delete your

comments, or cause them to be hidden behind another link, if we feel

they detract from the conversation. Commercial plugs are fine,

if they are relevant to the conversation, and if you don't

try to pretend to be a consumer. Annoying endorsements will be deleted

if you're lucky, if you're not a whole bunch of people smarter and

more articulate than you will ridicule you, and we will leave

such ridicule in place.